Keep your monthly earnings Steady.

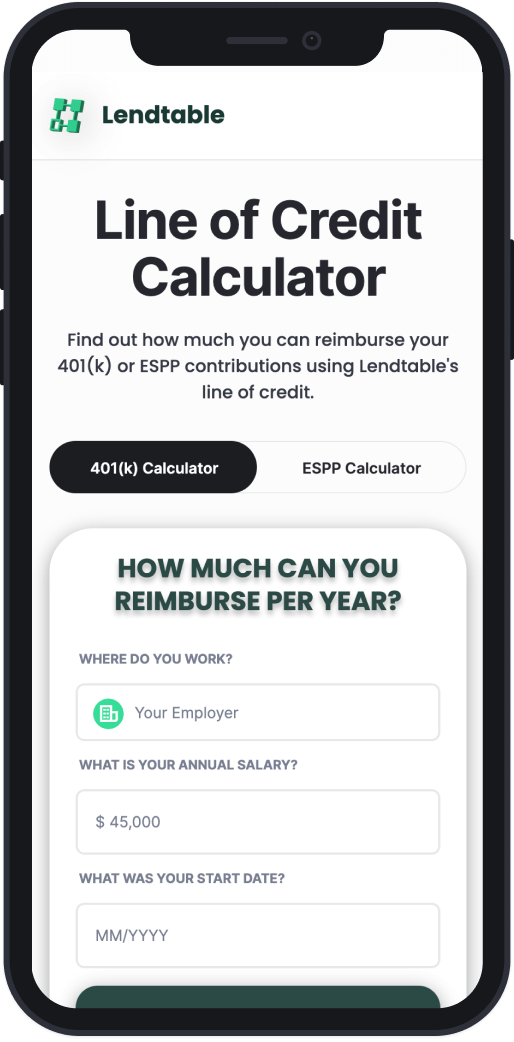

Max out your 401(k) match and ESPP. Keep your entire paycheck.

Lendtable supplies you with a line of credit that allows you to maintain your income while you contribute to your employee benefits programs.

See why Fortune 500 employees nationwide trust Lendtable.

How it works:

Hear from our customers:

Real stories from satisfied users

It's never too late.

Accelerate your long-term wealth on autopilot.

We can approve your completed application in the time it takes to make a cup of coffee. Get started now.

Contact

1475 Folsom St.

San Francisco

California

Newsletter

Subscribe to our newsletter to get more retirement planning tips and resources.

Lendtable Inc. ("Lendtable") is a consumer financial services platform. NMLS #2383190. NMLS Consumer Access

Lendtable is not a bank. Lendtable does not offer tax, legal, investment, or financial advice.

Copyright © 2024 Lendtable. All rights reserved